Hi,

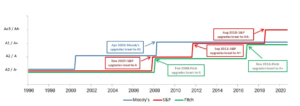

Yesterday Moody’s Investors Service had changed Israel credit rating from A1 to A2, and negative outlook.

The politicians are, of course, claiming this downgrade is because of the war (which makes sense, the same way they lowered Ukraine credit rating two days after the war began).

But something you must keep in mind is that Israel credit rating outlook was already negative for the eight months, 4 months before the war began. The reason for that is the judicial overhaul Bibi government had pushed for the last year (and some say was the reason Hamas look on Israel as weak and attacked on October 7th).

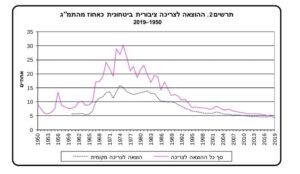

But the war does have a big effect on Israel economy. The amount of investment needed in secuirty and in the IDF, is much bigger than we had in the last years. After Yum Kippur war, Israel economy suffered from a lost decade. Security demands were very high, and 30% of the GDP went to IDF, police, and the rest of the forces, not leaving much for investment for future economy growth. The fear, is it will happen again after this war.

This is the first time Israel credit rating was lowered since it been joined to the national rating systems. The outlook is negative, and it might not be the last time it will be lowered.

With this government, that hope God will help us, and keeps spreading momey for uneffective sectors in the budget that was passed not long time ago, we might be heading for another last decade or even worse if we will not take steps in the right direction. And as this government do nothing to help us, we will not to start with changing it with new government.

Take Care

Gad

For the first time ever: Moody’s loweres Israel Credit rating.

For the first time ever: Moody’s loweres Israel Credit rating.

The history of Israel credit rating (Source: www.gov.il)

The history of Israel credit rating (Source: www.gov.il)

Israel secuirty expense as a precantage of the GDP 1950-2019 (Source: www.cbs.gov.il)

Israel secuirty expense as a precantage of the GDP 1950-2019 (Source: www.cbs.gov.il)